Customer Satisfaction Survey - A tailored approach

Customer Satisfaction Survey - A tailored approach

This newsletter details all you need to know about a tailored approach to Customer Satisfaction Surveys

Tony Nix ASA, MBA Director, Solutions Marketing & Consulting

Why so important?

Satisfied customers are usually return buyers. They also tell others about their experiences. They might also pay a premium for the privilege of doing business with a supplier they trust. Statistics suggest that the cost of keeping a customer is only 10% of the cost of acquiring a new one

However there are costs associated with implementing a customer retention program. First there is the cost of the survey. But long lasting improvements may need a fundamental transformation in the company, involving staff training and possibly cultural change. The result should be financially beneficial with less customer churn, higher market shares, premium prices, a stronger brand, improved reputation and more contented staff.

There are six parts to any customer satisfaction programme:

- Who should be interviewed?

- What should be measured?

- What research method should be used?

- How should ‘satisfaction’ be measured?

- What do the measurements mean?

- How to best implement the findings?

Who should be interviewed?

Consider a hoses & fittings manufacturer or importer. Who should be interviewed? Should it be the production line operator or foreman, the engineer, the purchasing officer or the General Manager of the company? In business to business markets there may be many influences on the buying decision from engineering, production, purchasing, quality assurance, and even research & development. Each department will have different criteria and will evaluate suppliers differently. An ideal customer satisfaction program may need to embrace the multiple views.

We need to ask the right question of the right person. This may require a compromise by focusing on one person, namely the primary decision maker.

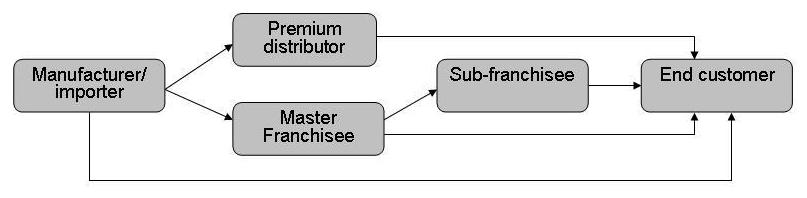

But what about the situation where there are multiple distribution channels?

In such a case each first-in-line customer (i.e., Premium Distributor, Master franchisees and direct end-customers) should be surveyed. In addition serious consideration should be given to surveying the sub-franchisees and end-customers not supplied directly by the manufacturer/ importer.

Also, much can be learned from lapsed customers and current non-customers who may be potential customers.

Finally, whomever is finally surveyed it is important that the data base used is accurate, up-to-date and specifically includes the key decision maker.

What should be measured?

We need to know how the brand is performing and how it can be improved. This will naturally involve high level questions and low level questions.

High level questions might include the following:

- What is your overall satisfaction with Brand X?

- How likely are you to buy from Brand X again?

- How likely are you to recommend Brand X to a colleague or friend? Note that this question can deliver a Net Promoter score by subtracting the % of Detractors (0-6 on a ten point scale) from the % of promoters (9-10 on the ten point scale). In the US Life Insurance market, Positive scores above o through to as high as 40% have shown positive CAGR rates up to 6% (Source: Harvard Business Review2003, Frederick Reichheld)

Low level questions help define the precise causes of satisfaction or dissatisfaction. But these may differ from industry to industry and even amongst different customer groups. Thus we need to think through these issues from the customer’s point of view.

Examples might include the following:

| Attribute Areas | Examples |

| Product | * Product quality |

| * Product life | |

| * Design | |

| * Range | |

| * Ease of installation | |

| * Warranties | |

| * Returns | |

| Delivery | * Speed of delivery |

| * On-time delivery | |

| Sales Service | * Technical knowledge |

| * Reliability | |

| * Friendliness | |

| * Responsive | |

| * Technical support | |

| * Problem resolution | |

| * After sales service | |

| * Long opening hours | |

| Company | * Reputation |

| * Administrative procedures | |

| Value | * Value for money |

Note that the list above would need to be tailored to a company’s specific needs. This may best be obtained by some internal focus groups with customer frontline staff. The results will be biased but they will be a good start. It may be wise to cross-check the information via some in-depth interviews with a few key customers.

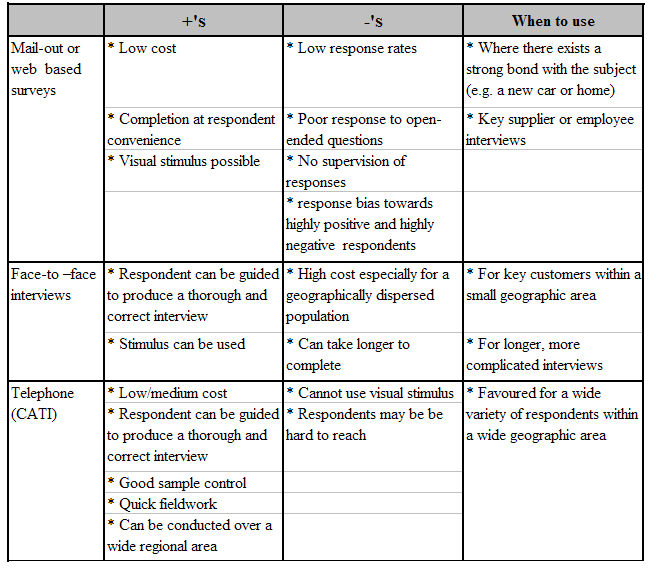

What research method should be used?

In order to provide a benchmark as well as the ability to track performance over time, a quantitative study is called for.

There are 3 possible methods:

- Mail-out or web based surveys.

- Face-to-face interviews

- Telephone interviews

Should the company sponsor be disclosed at the beginning or end of the survey? If disclosed at the beginning the survey, it is likely to elit more responses but some may be biased in their ratings? This can be mitigated by advice up front that no individual surveys will be made available to the sponsor, only the overall tabulated results. Thus the respondent can be encouraged to be absolutely frank and open with their responses. An alternative is to indicate at the start of the interview that the company sponsor will be disclosed at the end of the interview.

How should satisfaction be measured?

Usually 5, 7 or 10 point scales are used where the lowest figure indicates extreme dissatisfaction and the highest indicates extreme satisfaction.

Measuring ‘satisfaction’ is not enough. We need to know the’ importance’ of various attributes so we can action the satisfaction issues that are important rather than waste resources fixing the things that don’t really matter. By measuring ‘importance’ we are in effect measuring customer’s expectations. Often most attributes are thought to be important, so there is a risk of little differentiation in the ratings of importance. This can be overcome by ranking the importance of the nominated attributes but this can be a difficult & tedious procedure especially when there are many attributes.

One way around this is to group the low level attributes under the following main headings......

- Tangibles

- Reliability

- Responsiveness

- Assurance

- Empathy

.....and have the respondents allocate points to the five categories such that they add up to 100 points. Thus the respondent rates the relative importance of the categories overall as well as the individual attribute importance rating.

Another way is to statistically calculate (or ‘derive’) the importance of the various attributes by correlating the satisfaction levels of each attribute with the overall level of satisfaction. Where there is a high correlation with a particular attribute, it can be inferred that that particular attribute is driving customer satisfaction. This approach can show the greater influence of softer issues such as staff friendliness or the power of the brand, both things that respondents may not have ranked highly in the importance rating. This is where the more emotional attributes may come to the fore over rational attributes.

What do the measurements mean?

There are different ways to compute overall satisfaction index (CSI), namely:

- The overall performance rating

- The mean score of all attribute satisfaction ratings

- The mean score of all attribute satisfaction ratings * the importance rating

- The Net Promoter Score – The % of promoters - % of detractors

On a ten point scale –

- Mean scores of 8-10 is usually a market leading score

- Mean scores of 7-8 may mean adequate, but needs attention

- Mean scores below 7 indicate serious customer satisfaction issues

On a five point scale –

- Mean scores of 4-5 (very good to excellent) are required across all the important attributes

With respect to ‘The Net Promoter’ score, the more positive the score the better and ideally should be within the range (say) 40-80% depending on the industry. This requires a 9-10 score for half to ¾’s of customers as well as a low 5%-10% of detractor score. Essentially it is important to be well ahead of your main competitors and the industry average.

How to best implement the findings?

Conduct a Customer Value Analysis! The Customer Satisfaction research will have identified the main attributes that customer’s value and the importance that customers place on these attributes as well as the competitive performance ratings on the valued attributes. The key to gaining competitive advantage is to take each customer segment and examine how the company’s offer compares with that of its main competitor. The aim is to exceed the competitor’s offer on all important attributes.

Consideration should also be given to re-defining the segmentation, so the company exceeds the competitors offer in relation to each targeted segment.

In the process, certain important attributes may have to be improved in order to improve the competitive offer.

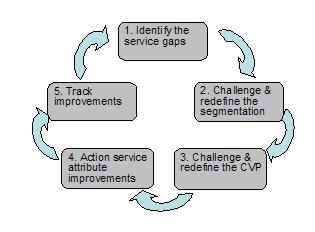

So a 5 step process is required to make lasting improvements to customer satisfaction & loyalty:

Step1: Identify gaps

- Find the attributes with low scores

- Target the important attributes

Step2: Challenge and possibly redefine the segmentation

- How do satisfaction scores vary across different customer segments?

- Are customer segments defined to best advantage?

- Does redefining a target segment improve the satisfaction index?

Step3: Challenge and possibly redefine the Customer Value Proposition (CVP)

- Is the CVP properly communicated to the market?

- Is the problem related to implementation?

- Is the CVP right for the target segment?

- Would a change in the CVP better satisfy the target segment?

Step4: Action the improvements

- Conduct a planning workshop

- Agree objectives

- Create cross-functional teams

- Appoint custodians

- Agree measureable targets

- Agree timelines

- Allocate resources

- Review progress

- Reward success

Step5: Track improvements

- Measure changes in the CSI index at least annually

- Is the change positive and significant?

- Modify the plan if necessary

- Repeat the process

Above all, remember that this is a continual process of improvement. The old adage ‘If it aint broke, don’t fix it” should never be followed in to-days increasingly competitive environment.

Only, consistent application and intensive customer centric focus & effort will keep a market leading company ahead of its competitors.

Want to know more? Contact Tony Nix on 02 9955 5133 for an obligation free discussion about your customer satisfaction measurement. In our research we dedicate ourselves to uncovering key market insights. In our analysis & strategy planning we aim to find solutions 'beyond the obvious!' Our offer is simply 'more for less' - more customer service insight for less cost ...guaranteed!